Medina, WA October 2025 Housing Market

September 2025 was a Buyer's market! The number of for sale listings was up 33.3% from one year earlier and up 3.7% from the previous month. The number of sold listings decreased 50% year over year and decreased 62.5% month over month. The number of under contract listings was up 33.3% compared to previous month and up 33.3% compared to previous year. The Months of Inventory based on Closed Sales was 9.3, up 165.7% from the previous year.

The Average Sold Price per Square Footage was up 16.7% compared to previous month and up 0.6% compared to last year. The Median Sold Price increased by 112.4% from last month. The Average Sold Price also increased by 66.1% from last month. Based on the 6 month trend, the Average Sold Price trend was "Appreciating" and the Median Sold Price trend was "Appreciating".

The Average Days on Market showed a upward trend, an increase of 122.2% compared to previous year. The ratio of Sold Price vs. Original List Price was 94%, a decrease of 6% compared to previous year.

Video edited on Kapwing

It was a Buyer's Market

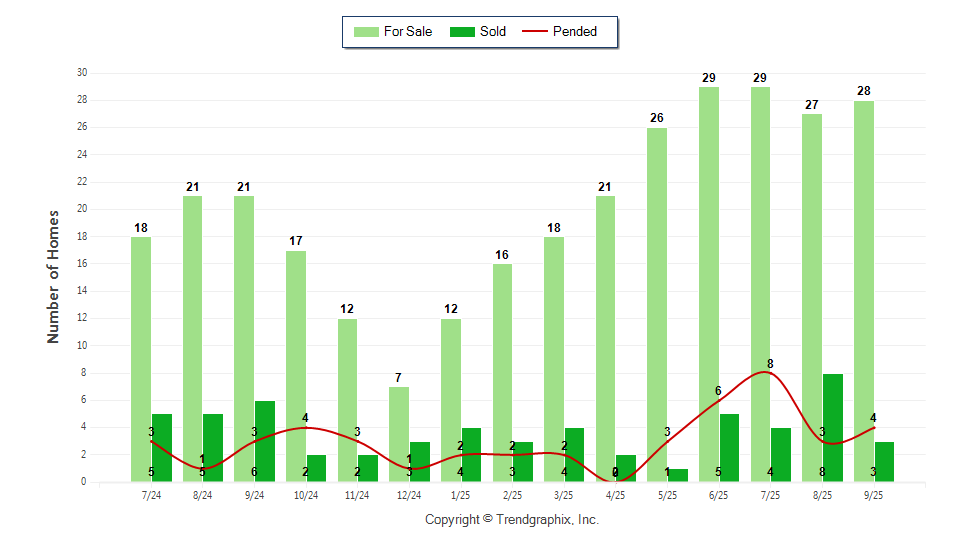

Property Sales (Sold)

September property sales were 3, down 50% from 6 in September of 2024 and 62.5% lower than the 8 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month was higher by 7 units of 33.3%. This year's bigger inventory means that buyers who waited to buy may have bigger selection to choose from. The number of current inventory was up 3.7% compared to the previous month.

Property Under Contract (Pended)

There was an increase of 33.3% in the pended properties in September, with 4 properties versus 3 last month. This month's pended property sales were 33.3% higher than at this time last year.

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

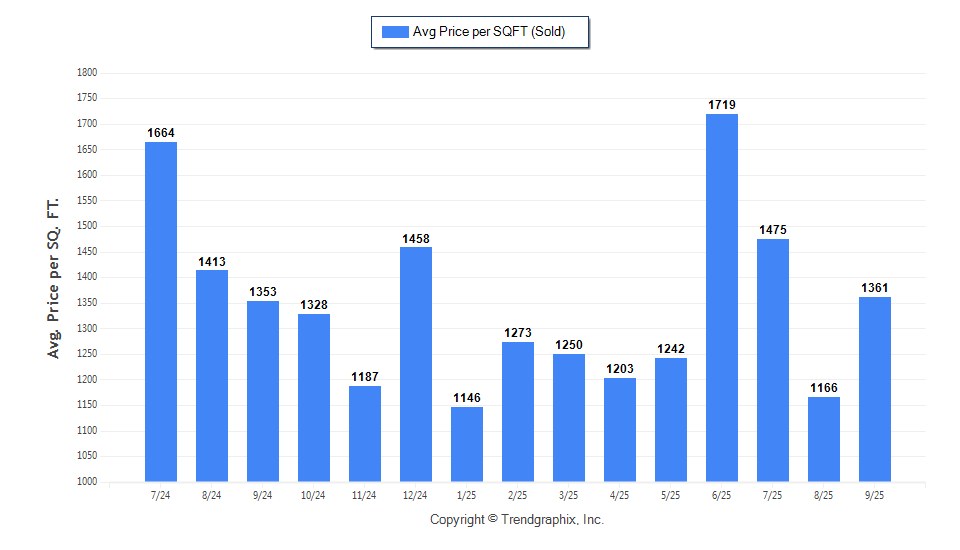

The Average Sold Price per Square Footage was Neutral*

The Average Sold Price per Square Footage is a great indicator for the direction of property values. Since Median Sold Price and Average Sold Price can be impacted by the 'mix' of high or low end properties in the market, the Average Sold Price per Square Footage is a more normalized indicator on the direction of property values. The September 2025 Average Sold Price per Square Footage of $1,361 was up 16.7% from $1,166 last month and up 0.6% from $1,353 in September of last year.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

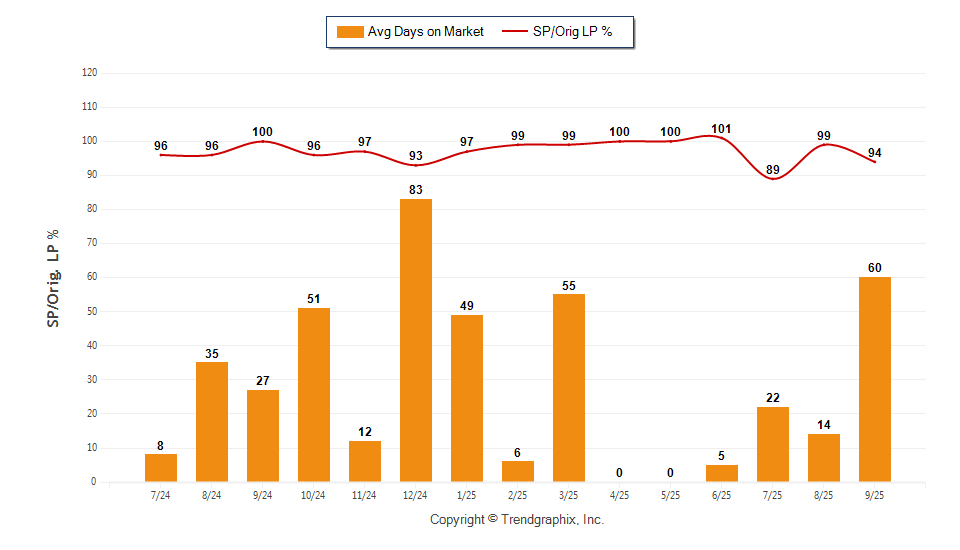

The Days on Market Showed Upward Trend*

The average Days on Market (DOM) shows how many days the average property is on the market before it sells. An upward trend in DOM trends to indicate a move towards more of a Buyer’s market, a downward trend indicates a move towards more of a Seller’s market. The DOM for September 2025 was 60, up 328.6% from 14 days last month and up 122.2% from 27 days in September of last year.

The Sold/Original List Price Ratio Remains Steady**

The Sold Price vs. Original List Price reveals the average amount that sellers are agreeing to come down from their original list price. The lower the ratio is below 100% the more of a Buyer’s market exists, a ratio at or above 100% indicates more of a Seller’s market. This month Sold Price vs. Original List Price of 94% was down 5.1% % from last month and down from 6% % in September of last year.

* Based on 6 month trend – Upward/Downward/Neutral

** Based on 6 month trend – Rising/Falling/Remains Steady

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

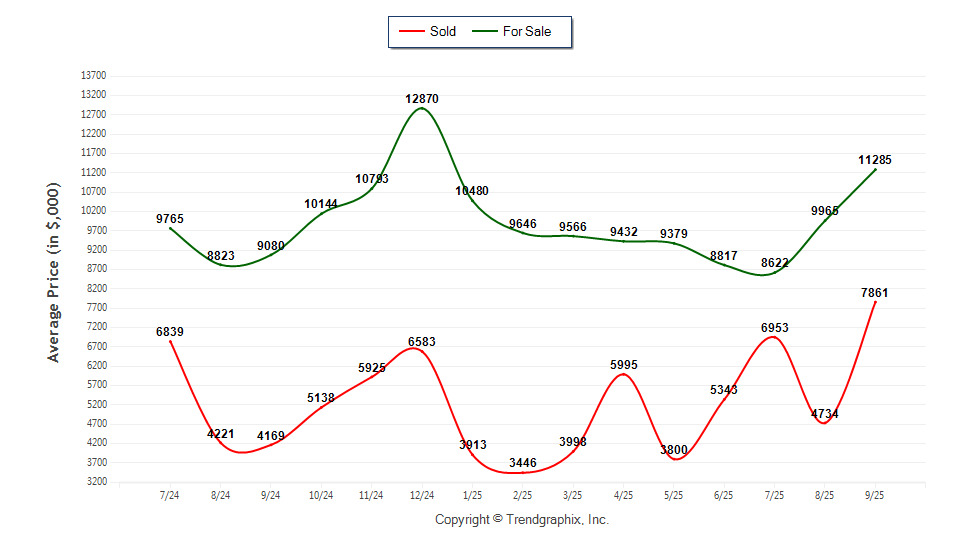

The Average For Sale Price was Appreciating*

The Average For Sale Price in September was $11,285,000, up 24.3% from $9,080,000 in September of 2024 and up 13.2% from $9,965,000 last month.

The Average Sold Price was Appreciating*

The Average Sold Price in September was $7,861,000, up 88.6% from $4,169,000 in September of 2024 and up 66.1% from $4,734,000 last month.

The Median Sold Price was Appreciating*

The Median Sold Price in September was $7,700,000, up 126.5% from $3,400,000 in September of 2024 and up 112.4% from $3,626,000 last month.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

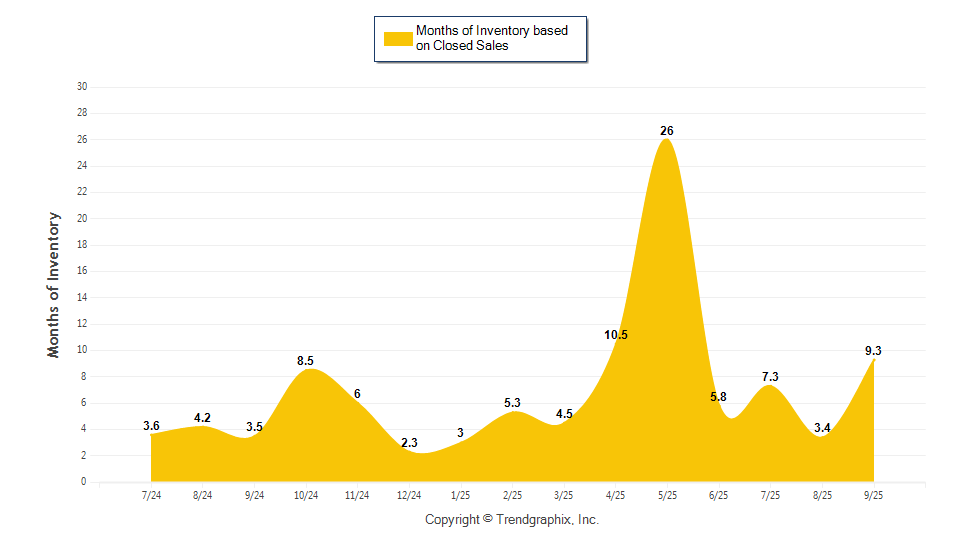

It was a Buyer's Market*

A comparatively lower Months of Inventory is more beneficial for sellers while a higher months of inventory is better for buyers.

*Buyer’s market: more than 6 months of inventory

Seller’s market: less than 3 months of inventory

Neutral market: 3 – 6 months of inventory

Months of Inventory based on Closed Sales

The September 2025 Months of Inventory based on Closed Sales of 9.3 was increased by 165.7% compared to last year and up 174.8% compared to last month. September 2025 was Buyer's market.

Months of Inventory based on Pended Sales

The September 2025 Months of Inventory based on Pended Sales of 7 was the same compared to last year and down 22.2% compared to last month. September 2025 was Buyer's market.

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

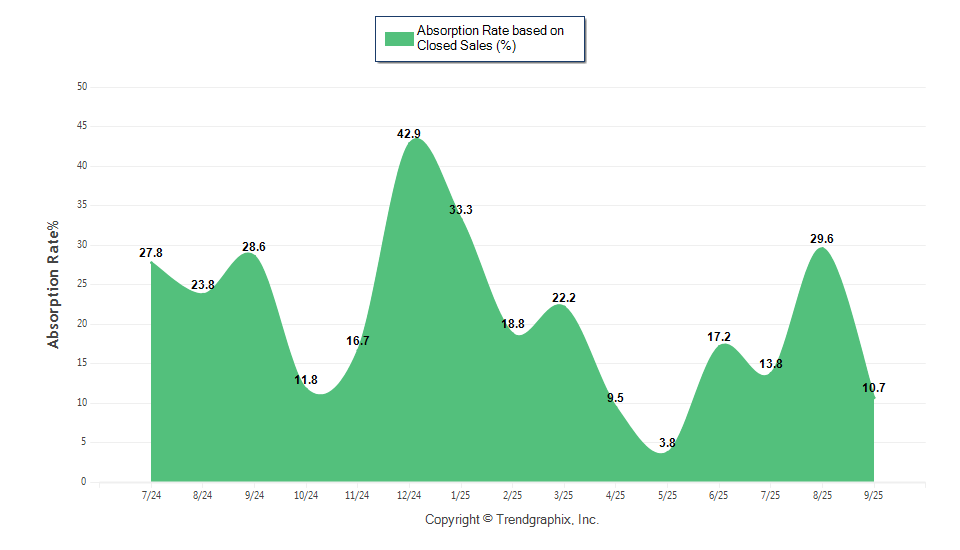

It was a Buyer's Market*

Absorption Rate measures the inverse of Months of Inventory and represents how much of the current active listings (as a percentage) are being absorbed each month.

*Buyer’s market: 16.67% and below

Seller’s market: 33.33% and above

Neutral market: 16.67% - 33.33%

Absorption Rate based on Closed Sales

The September 2025 Absorption Rate based on Closed Sales of 10.7 was decreased by 62.6% compared to last year and down 63.8% compared to last month.

Absorption Rate based on Pended Sales

The September 2025 Absorption Rate based on Pended Sales of 14.3 was the same compared to last year and up 28.8% compared to last month.

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

www.GeorgeMoorhead.com

©Copyright 1998-2025. All Rights Reserved